Beyond Pattern Matching: How FalconHealth's AI Agents Think Like Healthcare Fraud Investigators

by Yubin Park, Co-Founder / CTO

Healthcare fraud, waste, and abuse drains an estimated $760-935 billion from the US healthcare system annually. That's roughly 25% of all healthcare spending, according to JAMA research [1]. Even by conservative estimates, Medicare and Medicaid alone reported over $100 billion in improper payments in 2023 [2]. Traditional detection methods are fighting a losing battle, and we at falcon health believe it's time for a fundamentally different approach.

The Problem with Playing Catch-Up

Most healthcare FWA detection systems today work like security cameras that only recognize faces they've seen before. They're trained on historical fraud cases (the schemes that have already been caught, investigated, and confirmed through lengthy legal processe). But here's the catch: confirmed fraud cases represent less than 1% of all healthcare claims [1]. By the time a billing scheme is identified and prosecuted, fraudsters have already moved on to new tactics.

Top tip

The challenge gets worse. Healthcare fraud patterns constantly evolve. What worked to catch improper billing last year might miss this year's schemes entirely [2]. Think of it like a game of whack-a-mole where the moles keep changing color, size, and speed. Traditional machine learning models, no matter how sophisticated, are essentially memorizing yesterday's moles.

Enter the AI Investigator

At falcon health, we asked ourselves: what if instead of pattern matching, we built AI agents that think like seasoned healthcare fraud investigators? Real investigators don't just look for known fraud patterns. They understand the economics of healthcare, spot anomalies that "just don't feel right," and build cases by connecting dots across multiple data sources.

Top tip

Our approach uses a team of specialized AI agents, each focused on a different aspect of provider behavior:

- Address Analysis Agent: Tracks provider location patterns and organizational structures to identify suspicious billing arrangements.

- Billing Analysis Agent: Monitors quarterly billing trends, service concentration, and sudden shifts in practice patterns.

- LCD Compliance Agent: Checks whether services align with Medicare's Local Coverage Determinations. Essentially the rulebook for what's covered and when.

- Peer Comparison Agent: Spots statistical outliers by comparing providers to their specialty peers.

- Specialty Alignment Agent: Flags when providers bill for services outside their medical training.

- Upcoding Detection Agent: Identifies patterns of consistently billing the most complex (and expensive) version of procedures.

- Entity Analysis Agent: Unravels complex business structures that might obscure improper billing.

Building the Case, Not Just Flagging Anomalies

Here's where it gets interesting. These agents don't work in isolation. They collaborate through an Aggregator Agent that acts like a lead investigator. When multiple agents flag concerns about the same provider, the system recognizes these as corroborating evidence. A cardiologist billing unusual volumes might be explained by subspecialization, but if they're also showing rapid address changes, excessive organizational complexity, AND services outside their specialty? That's when our system raises the alarm.

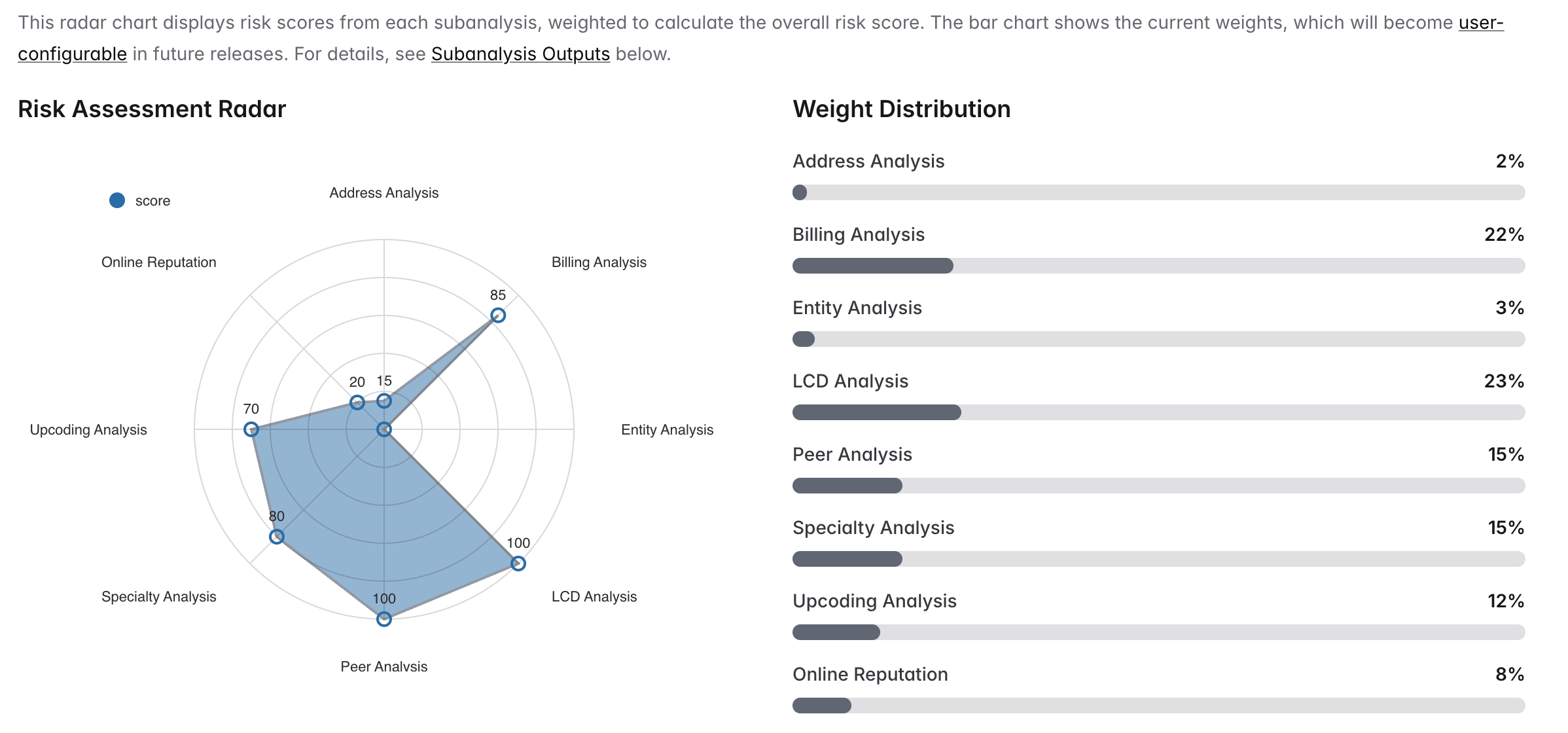

Our Risk Assessment Dashboard visualizes how each specialized agent contributes to the overall fraud risk score. The radar chart shows individual risk scores while the weight distribution reflects each agent's relative importance in the final assessment.

The Aggregator weighs evidence based on reliability and impact, but also understands the limitations of each data source and specialized agent. LCD violations (23% weight) and billing anomalies (22% weight) carry more weight than address changes (2%), while peer outliers (15%) matter more when combined with high denial rates. However, the system dynamically adjusts these weights when data quality issues arise. For instance, reducing reliance on peer comparison analysis when specialty benchmarks are sparse, or increasing emphasis on LCD compliance when claims data is incomplete. It's not about catching every anomaly. It's about building investigative narratives that make sense to human reviewers while accounting for the inherent limitations and blind spots of each investigative agent.

The Human-AI Partnership

We've integrated human expertise directly into our system through a Human-in-the-Loop (HITL) approach [3]. When our agents surface potential fraud, experienced investigators can provide feedback that helps the system learn and adapt. This isn't just about improving accurac — it's about ensuring our AI understands the nuances that only come from years of healthcare fraud investigation experience.

Our agents also tap into external data sources through web searches and public healthcare databases like mimilabs, adding context that proprietary claims data alone can't provide. Did a provider recently face sanctions? Are there online complaints about billing practices? This real-world context helps separate the suspicious from the explicable.

Why This Matters

The shift from pattern matching to investigative reasoning isn't just a technical improvement. It's a fundamental rethinking of how we protect healthcare program integrity. Instead of always being one step behind fraudsters, we're building systems that can reason about vulnerabilities, anticipate new schemes, and adapt as quickly as the fraudsters do.

For healthcare payers, this means catching improper billing before it becomes a massive loss. For legitimate providers, it means fewer false positives and unnecessary audits. And for all of us as patients and taxpayers, it means a healthcare system where resources go to actual care, not fraudulent claims.

Looking Ahead

The future of healthcare fraud detection isn't about building better mousetraps — it's about building smarter investigators. Our AI agents represent just the beginning of this transformation. As these systems learn from each investigation, they become more sophisticated at understanding the complex web of relationships, incentives, and behaviors that drive healthcare fraud.

At falcon health, we're not just detecting fraud. We're reimagining how technology and human expertise can work together to protect the integrity of our healthcare system. Because when it comes to the $300 billion problem of healthcare fraud, playing catch-up is no longer good enough.

Want to learn more about how FalconHealth's investigative AI agents can protect your healthcare program? Contact us for a demo.

References

[1] Shrank WH, et al. Waste in the US Health Care System: Estimated Costs and Potential for Savings. JAMA, 2019. https://pubmed.ncbi.nlm.nih.gov/31589283/

[2] GAO. Medicare and Medicaid: Additional Actions Needed to Enhance Program Integrity and Save Billions. U.S. Government Accountability Office, 2024. https://www.gao.gov/products/gao-24-107487

[3] Wu, X., Xiao, L., Sun, Y., Zhang, J., Ma, T., & He, L. A survey of human-in-the-loop for machine learning. Future Generation Computer Systems, 135, 364-381, 2022. https://doi.org/10.1016/j.future.2022.05.014